The corporate treasury industry has undergone significant shifts in recent years, driven primarily by sustained high interest rates and concerns over bank stability. These factors have forced companies to reevaluate their cash management strategies and prioritize fundamental practices, such as cash forecasting, optimizing deposit allocation, and mitigating rising bank fees. In the months ahead, even with a few potential rate cuts on the horizon, corporate treasuries will need to focus on cash management fundamentals with diligent attention paid to bank fees and how cash is deployed.

Rate Cuts

This recent period of high interest rates has compelled companies to adjust their cash balance management strategies to adapt to a more normalized rate environment not seen since 2008. For over a decade, near-zero interest rates produced a state of apathy towards balance management across many organizations, but the current environment, despite potential modest rate cuts, still necessitates a more diligent approach to cash management.

Migration to Higher-Rate Deposit Products

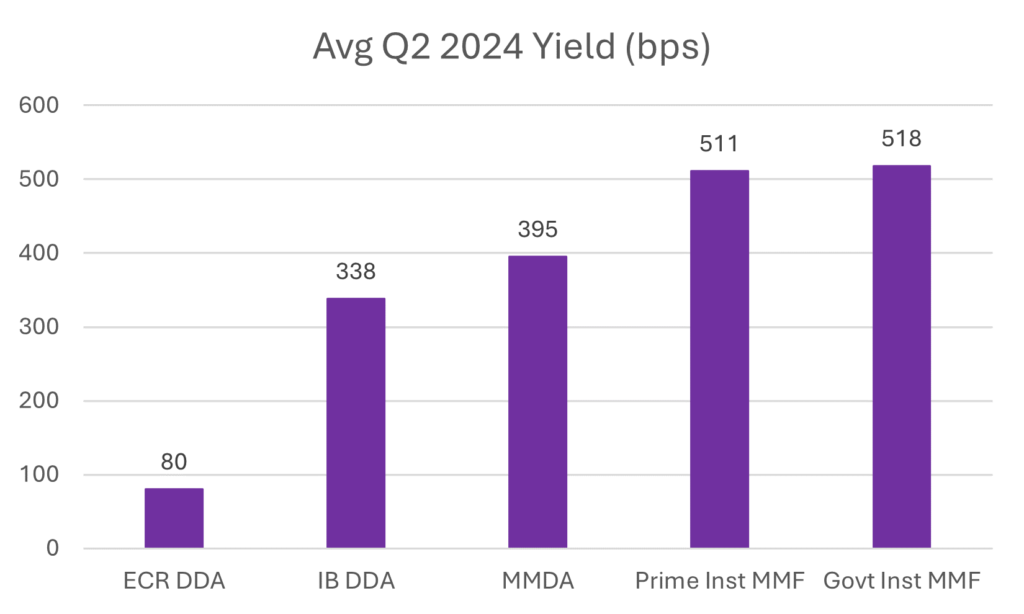

While many businesses have taken action to migrate to higher-rate deposit products, such as moving funds out of earnings credit rate (ECR) accounts and into interest bearing accounts or money market funds (MMFs), a significant portion of the market remains slow to react. This inertia may stem from a lack of awareness or understanding of the benefits of higher-rate deposit options. However, the opportunity cost should not be overlooked, as companies remaining in ECR accounts may be leaving significant interest income on the table.

Return to Fundamentals

The current landscape and projections for the foreseeable future highlight the importance of returning to the fundamentals of cash management. This includes optimizing deposit allocation, maximizing return on invested capital, and effectively forecasting cash flows. Companies are also focusing on mitigating the impact of rising bank fees, which have become a significant operational expense.

Optimizing Available Capital

With an emphasis on optimizing available capital, companies are exploring various strategies, such as paying down debt and making strategic investments. This requires careful balance and coordination between different financial objectives, including liquidity management and risk mitigation.

Conclusions

The corporate treasury industry has undergone a period of transition, and many companies have yet to adapt in response. Companies should be refocusing on core cash management practices, diversifying banking relationships, diligently managing bank fees, and optimizing available capital to navigate the challenges of the current landscape. Moving forward, a proactive approach to cash management will be essential for businesses to maintain financial stability and competitiveness in an increasingly complex environment.

For more information on how Treasury Strategies, a division of Curinos, can help your firm optimize balances, manage bank fees, and adapt to the landscape ahead, please contact us at ndepth-info@treasurystrategies.com